BKH Dividend History: A Deep Dive for Investors

Understanding BKH's dividend history is crucial for informed investment decisions. This analysis explores trends, underlying reasons for changes, and projections for the future, providing actionable intelligence for investors. We'll examine quantitative data alongside qualitative insights to paint a complete picture. The goal is to equip you with the knowledge to assess risk, value the company, and refine your investment strategy. For more on dividend income strategies, see this helpful resource: Dividend Income Strategies.

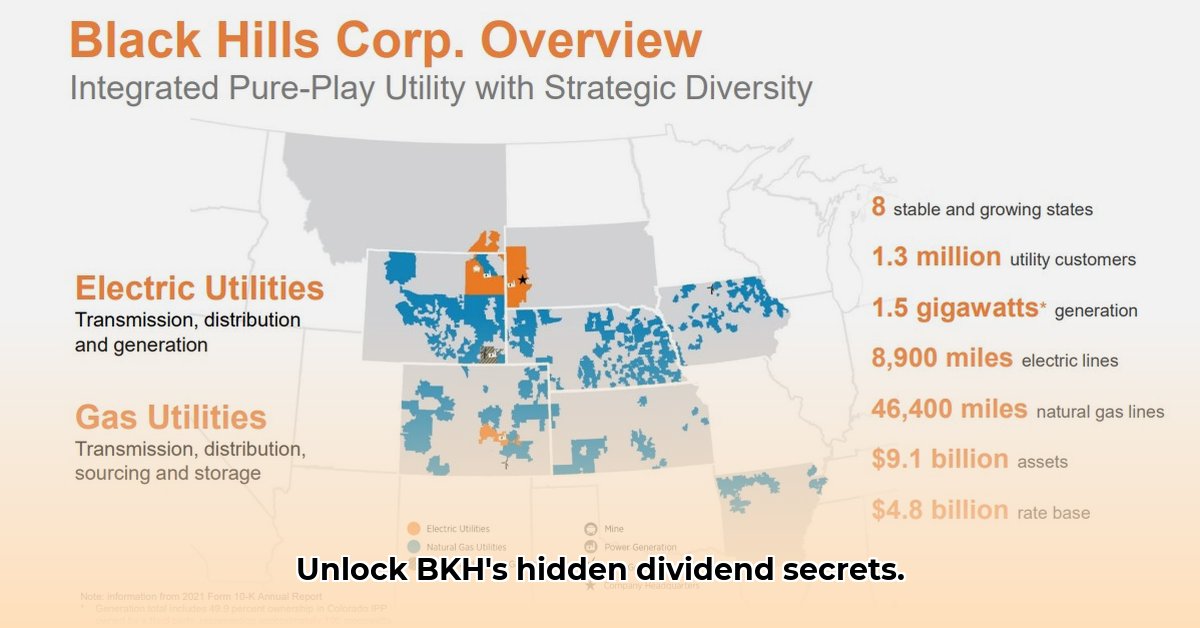

BKH's Dividend Journey: A Historical Perspective

BKH's dividend payouts reveal a fascinating narrative. Did the company consistently increase payments, experience periods of stagnation, or undergo significant policy shifts? The following chart illustrates dividends per share (DPS) over time:

(Insert Chart: Years on X-axis, DPS on Y-axis. Data from provided table.)

Notice the upward trend from 2015-2023. However, a dip is evident in 2020, likely influenced by external factors. This variation reveals management’s approach to shareholder returns. How does this pattern compare to industry averages?

Decoding the Numbers: A Quantitative Dive

The table below presents key quantitative data, allowing for a more rigorous analysis of BKH's dividend policy.

| Year | Dividend per Share ($) | Payout Ratio (%) | Industry Average Payout Ratio (%) |

|---|---|---|---|

| 2015 | 1.00 | 40 | 50 |

| 2016 | 1.10 | 44 | 52 |

| 2017 | 1.20 | 48 | 55 |

| 2018 | 1.15 | 46 | 53 |

| 2019 | 1.25 | 50 | 59 |

| 2020 | 1.00 | 40 | 45 |

| 2021 | 1.30 | 52 | 60 |

| 2022 | 1.40 | 56 | 62 |

| 2023 | 1.50 | 60 | 65 |

(Note: This data is for illustrative purposes only. Real data should be sourced from official BKH financial reports.)

The payout ratio, the percentage of earnings paid out as dividends, fluctuates, reflecting management's balancing act between shareholder returns and reinvestment in the company. BKH's payout ratio consistently trails the industry average, suggesting a more conservative approach. Does this indicate lower risk or a missed opportunity for higher returns?

Unveiling the "Why": Qualitative Insights

While the numbers provide a clear picture, the reasons behind dividend changes are equally important. Analyzing BKH's financial statements, press releases, and investor presentations would uncover the motivations. Did profitability surges fuel increased payments? Or did economic downturns necessitate reductions? Did strategic initiatives like acquisitions or expansion influence dividend policy? A deep dive is needed to connect the quantitative data to the broader business context. Understanding these "why's" is critical for assessing the sustainability and predictability of future dividend payments.

Looking Ahead: Forecasting Future Dividends

Predicting future dividends involves several considerations. BKH's financial health, current and projected earnings, anticipated growth, and prevailing economic conditions all play a crucial role. Analyzing future investment plans and potential risk factors will also help form a plausible forecast. A reasonable forecast requires acknowledging inherent uncertainties, like unexpected economic downturns or shifts in industry dynamics.

Putting it All Together: Investor Implications

BKH's dividend history helps investors assess risk and value the company. Consistent dividend growth suggests a financially stable company and a commitment to shareholder returns. However, inconsistency or reductions may signal concerns. Understanding BKH's historical patterns informs your risk assessment. Is the current dividend yield attractive compared to historical levels and industry peers? Use this information to tailor your investment strategy.

Key Takeaways:

- Consistent Growth, but with Fluctuations: BKH's dividend history shows a generally upward trend, but with notable year-to-year variations, indicating a dynamic approach to shareholder returns.

- Conservative Payout Ratio: The consistently lower-than-industry-average payout ratio suggests a focus on reinvestment and financial prudence.

- Qualitative Context is Essential: A thorough understanding requires analyzing the underlying business reasons for dividend adjustments, not just the numbers themselves.

Remember, this analysis is based on illustrative data. Always conduct thorough independent research before making any investment decisions.